There are endless reasons to consider investing in property, particularly in the UK. Below we will explore some of these benefits.

- Cash from investment

- Appreciation

- Portfolio diversification

- Tax Deductions

- Property taxes

- Mortgage interest

- Property management fees

- Property insurance

- Ongoing maintenance costs

- Repair costs

- Marketing costs.

- Real estate leverage

It might seem obvious, but people often don’t realise how much they could receive in cash flow from investing in a property after paying the mortgage and operating expenses. In most cases, cash flow only improves over time as the mortgage(s) are paid off, and your equity is built. Investors often regard investing in commercial and residential property to boost monthly income rather than a sole income. Cash flow is generated by renting your commercial or residential space out to tenants who will provide you with a monthly income.

*Always research the payment histories of potential tenants if you want to reduce the likelihood that they will stop paying their rent.

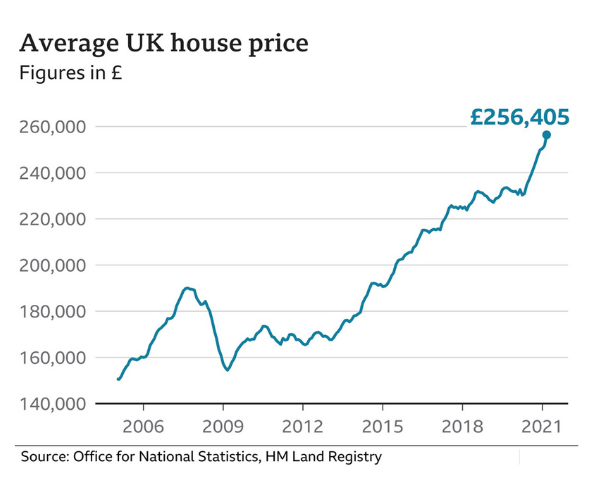

Appreciation is the increase in the value of an asset over time. Alongside real estate, other assets that appreciate over time including stocks, bonds, private equity and savings accounts. Not only is it possible to make a profit when it’s time to sell, but rent figures appreciate over time also, meaning that there are two possibilities for long term profits.

Since real estate has an extremely low correlation with other major asset classes, adding real estate to your portfolio can decrease the volatility of your portfolio. A diverse portfolio is more likely to be protected during economic turmoil. It also provides a higher return on risk, which is hugely beneficial to investors.

When investing in real estate, there are tax benefits. You can deduct several expenses associated with owning an investment property in certain countries. This includes:

Moreover, suppose you sell your property for more than you paid (which is likely due to the value of property appreciation, see point 2, it will not be classed as income but rather capital gains, which generally have lower rates than income.

Leverage in real estate is using borrowed money to buy a property. This borrowed money can be from banks, mortgage lenders, or credit unions to be paid back over time. For example, a 20% down payment on a mortgage gets you 100% of the house you want to buy. When leveraging, you borrow funds from a lender to be able to purchase an investment property rather than having to cover the cost yourself, making the process more accessible for first-time lenders.

Other benefits of investing in real estate

Other positives of investing in real estate include:

- Having long term financial security

- Having personal fulfilment from being your own boss, providing homes to the community and bringing business to commercial property.

- Achieving higher capital values from inflation hedging.

Drawbacks of investing in property

Although there are endless benefits to investing in real estate, every investment has potential risks and drawbacks.

- Real estate is not a liquid investment.

It is easy to sell other assets like stocks and bonds quickly and efficiently to access your cash. With real estate, once you invest in a property, you would have to sell some or all of that property to access your money.

- A sizeable amount is needed to begin.

Before investing in real estate, you need to have a reasonable starting capital. Residential and commercial properties are not cheap.

- You have to wait some time before seeing the benefits of your investment.

As shown near the beginning of this article, waiting for the appreciation of real estate value can be a long process. Although you will be receiving money each month in the form of rent, this only covers the cost of the mortgage and other expenses. The real profits are made when you can sell the property for a higher value than what you bought it for, which usually takes some years.

- Location is key.

Suppose your investment property is in an area where real estate prices are not on the rise; your property probably won’t increase in value. It is essential to research the location of your properties before you purchase them to be sure you will make a profit.

Real estate investments in UK property

At NCAP Savings, we offer several ways to invest in UK real estate so you can benefit from all of the opportunities we have shown.

For more information about our fixed interest rates of 8%+ per annum and purchasing buy-to-let properties, click here.

To speak to one of our expert team today, call 020 8629 3606 (UK) or +971 4 850 0818 (UAE). Alternatively, email [email protected] or fill out an online enquiry form, and someone will get back to you.

Recent Comments